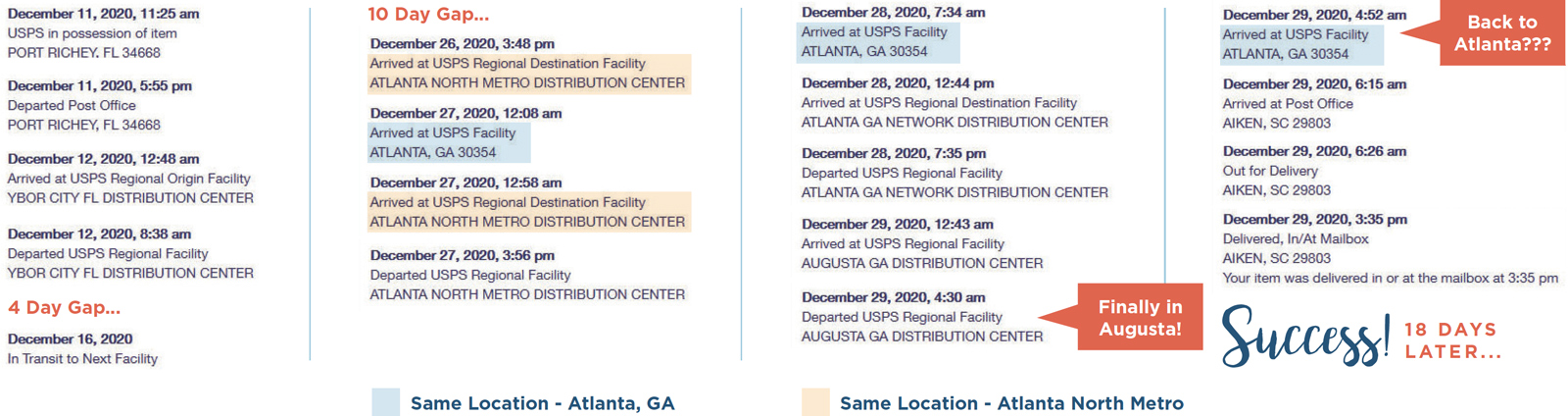

I placed the order on December 10, in plenty of time for delivery by Christmas. It shipped, by First Class Mail for $4.75, on December 11. When it had not arrived a week later, I asked for the tracking number, and then I checked the tracking history each day (see below).

For several days the tracking history showed a mysterious message that later disappeared:

Your package will arrive later than expected, but is still on its way. It is currently in transit to the next facility.

My package sat in Florida for 4 days, and then took 10 days to make it to North Atlanta (by mule perhaps?). Once in North Atlanta it appears to have gotten confused, because it went to Atlanta, back to North Atlanta, then back to Atlanta for the 2nd time. Bored, it took a side trip across the state (and closer to its final destination) to Augusta, but then went back to Atlanta for the 3rd time before finally arriving in Aiken on December 29.